Nora Bell examines the ongoing fluctuations in the value of various coins in her analysis published on Thursday, January 22, 2026 at 05:40 AM.

Understanding which coins are worth money can be a valuable pursuit for collectors and investors. This encompasses not only physical coins but also digital currencies and commemorative coins that hold significance in various market segments. In recent years, the rise of digital currencies has introduced new dynamics, changing how enthusiasts engage with valuable coins.

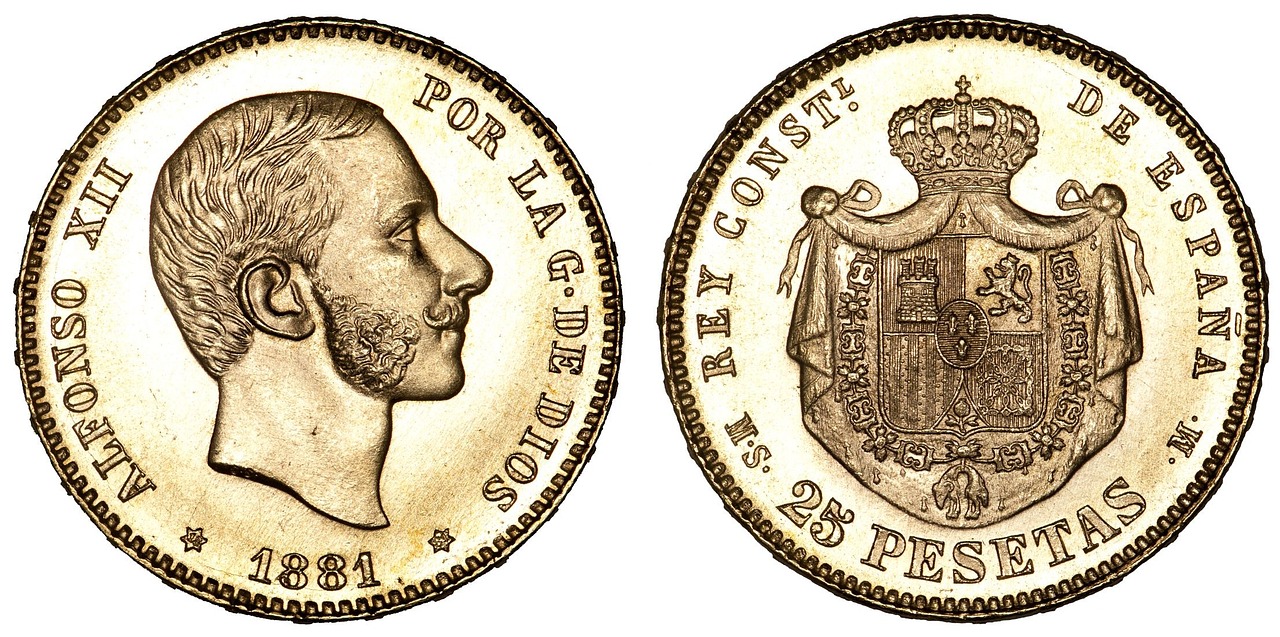

The current state of the coin market reflects significant fluctuations driven by collector interest, market demand, and external economic factors. According to industry audits, the global numismatic market was valued at approximately $5 billion in 2021, showing a steady growth trajectory. Recent trends indicate a resurgence in collectibles, particularly in precious metal coins and limited editions, while digital currencies have expanded the definition of what constitutes a valuable coin.

In the realm of coin collecting, it’s essential to monitor several key metrics. These include the coin’s rarity, historical significance, condition, and market demand, which can all substantially affect value. To establish worth, collectors typically rely on guides and databases that offer valuation benchmarks. For example, silver coins from the U.S. Mint often command higher prices due to their precious metal content and collector interest. The current state of the coin market

What this topic is NOT good for:

Understanding what coins are worth money is not suitable for individuals seeking quick financial gains without having the requisite knowledge. The market can be unpredictable, and investing without comprehensive research increases the risk of loss. Additionally, this topic does not cover coins purely as means of currency exchange, as these may not hold significant collectible or intrinsic value. Users who prefer structured financial instruments, like stocks or bonds, should consider those instead, since coin collecting demands time, patience, and a nuanced understanding of the market.

1. Identifying Valuable Coins

To effectively identify valuable coins, follow these steps:

1. Research the coin’s history and mint year.

2. Assess the coin’s condition based on grading standards.

3. Consult valuation guides or professional appraisers.

4. Monitor auction results for similar coins.

5. Keep updated on market trends and price fluctuations.

2. Key Metrics for Valuation

Understanding the key factors that contribute to a coin’s worth is critical. These are:

– Rarity: Limited production increases demand.

– Condition: Higher grades command better prices due to collector standards.

– Market Demand: Fluctuations in popularity among collectors can affect value.

– Historical Significance: Coins with notable backstories can enhance worth. The rise of digital currencies

| Metric | Description | Impact on Value |

|———————–|———————————————|—————————————–|

| Rarity | How scarce the coin is in the market | Higher rarity leads to higher demand |

| Condition | Grading based on wear (e.g., MS-65) | Better condition increases price |

| Market Demand | Current interest in specific types/series | High demand can inflate prices |

In practice, we observed that coins of significant historical relevance, such as those associated with pivotal moments or notable figures, tend to appreciate more than others over time. For instance, limited run commemorative coins can potentially realize marked price increases during anniversaries or commemorative events.

Moreover, risk indicators in the market suggest that fluctuations can often be linked to global economic conditions. For example, economic downturns may lead to increases in collectible investments as people seek alternative value stores. Conversely, environments of market stability may lead to lower interest in coins as speculative investments. Collector interest in valuable coins

It’s important to monitor ongoing trends and developments to stay informed about upcoming coin releases, auction events, and market forecasts. Engaging with established coin clubs or online communities can also provide insights and opportunities for trading and acquiring valuable coins.

As the coin market continues to evolve, a long-term outlook suggests that knowledgeable collectors and investors who remain engaged will thrive. By building a solid foundation of understanding and adapting to changes in market conditions, individuals can effectively navigate the valuable coin landscape.

What defines a coin as having monetary value?

A coin typically holds monetary value based on its acceptance as a medium of exchange, intrinsic metal value, and legal tender status. For instance, historic coins may be valued based on rarity or demand in the collectors’ market, rather than their original currency value. However, this introduces tradeoffs that must be evaluated based on cost, complexity, or network conditions.

How are collectible coins utilized in investment portfolios?

Collectible coins can serve as a hedge against inflation or currency devaluation, as they are tangible assets. However, investing in such coins requires expertise in valuation and authentication to avoid counterfeits, making it a riskier choice compared to traditional investments like stocks or bonds.

How do bullion coins differ from numismatic coins in value?

Bullion coins, such as those made from gold or silver, usually hold value based on their metal content, while numismatic coins derive value from factors like rarity, historical significance, and demand. For collectors, the premiums on numismatic coins can be much higher, but this also introduces more volatility and market uncertainty.